Imagine this: A construction company completes a commercial infrastructure project within the scope and scheduled timeline. It met all quality standards as well as the stakeholders’ expectations. But the real question is, was the project profitable for the construction firm? To find out, the company must calculate the project ROI.

Project ROI is a key performance metric that evaluates the financial return generated from a project relative to its cost.

It plays a crucial role at both ends of the project lifecycle. In the initiation phase, ROI helps assess feasibility, forecast potential returns, and justify the investment. Meanwhile, at the closure phase, it reveals the actual financial impact and determines whether the project delivered real value to the clients or stakeholders.

In this blog, we will cover everything about ROI in project management. We will understand its importance and learn how to calculate it in 5 simple steps.

Let’s begin!

What is Project ROI?

Project ROI is an important financial metric that helps organizations estimate the project’s profitability. It is calculated by comparing revenue to the total cost of the project. A higher ROI indicates that a project is financially beneficial, while a lower ROI can signal potential losses.

ROI signifies a project’s value in financial terms, enabling managers to justify their decisions to stakeholders. Moreover, by calculating ROI in project management, organizations get a guiding path to improve plans and align their project efforts with broader business goals.

Project ROI Formula

It is always a good practice to measure the ROI for a project before it begins and then after it is completed. However, managers can also calculate it irrespective of the stage a project is in to assess ongoing profitability. The simple formula to calculate project ROI is:

| ROI (%) = (Net Profit / Total Project Cost) X 100 |

|---|

In this, net profit can be calculated by using the formula:

| Net Profit = Total Revenue – Total Project Expenses |

|---|

By using these formulas, organizations can gain clear insights into the financial performance at any stage of the project lifecycle and make informed decisions moving forward.

Having understood the project ROI meaning and the formula for calculating it, let us learn its different types.

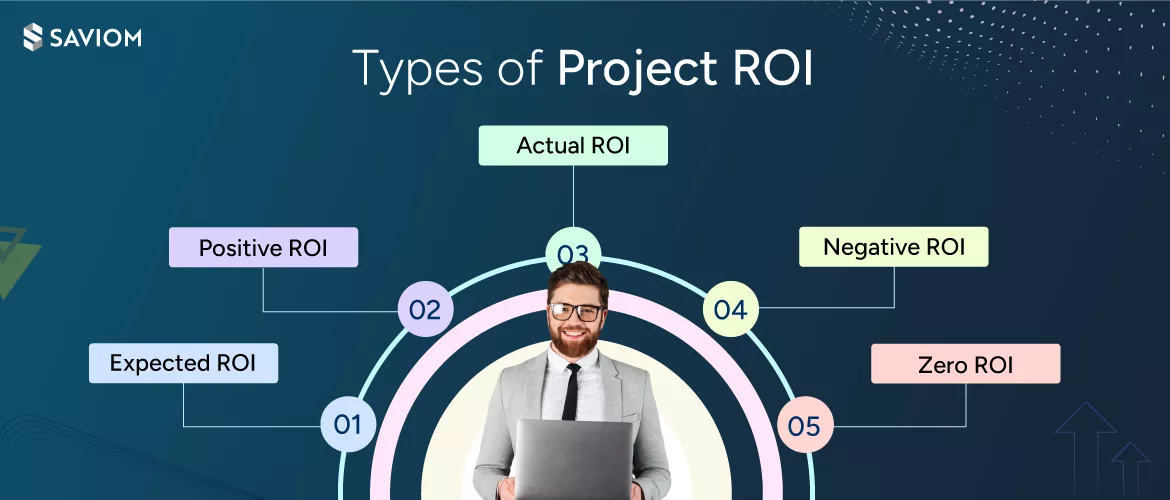

Types of Project ROI

As stated earlier, ROI can be calculated at various stages of the project lifecycle. Depending on when and how it is measured, the different types of project ROI are:

Expected ROI

Expected or anticipated ROI is calculated before the project officially begins. It’s computed based on expected project expenses and forecasted revenue, which helps stakeholders assess if a project is financially viable. In addition, if an organization has multiple projects in the pipeline, expected ROI can help decide which project to select and prioritize.

Actual ROI

The actual or true ROI of a project is calculated when it is completed. To measure this, managers use the recorded costs of the project and the final profits generated by it. By comparing the actual vs. expected returns, project stakeholders can assess how closely the project aligns with initial expectations. Moreover, this evaluation also helps refine budgeting and execution strategies for future projects.

Positive ROI

It signifies that a project has gained more revenue or value compared to its investment costs. Positive ROI is an essential indicator of a project’s financial success; therefore, achieving it is the ultimate goal of organizations. Moreover, it helps managers identify what works best for them and plan pipeline projects using similar budgeting techniques.

Negative ROI

A negative ROI is an indicator of financial loss for an organization. It signifies that a project’s investment costs exceed the total profits generated by it. Although negative ROI is undesirable, it highlights underlying issues such as inaccurate cost estimation or poor resource planning. Managers can analyze these gaps to strengthen future project performance.

Read More: Proactive Resource Planning (PRP): Driving Agility, Growth, and Resilience

Zero ROI

A zero project ROI indicates neither loss nor gain. This means while the project was delivered within the budget and timeline, it didn’t generate any additional financial benefits for the organization. These kinds of projects are usually pursued by firms if they result in strategic gains, such as expanding their project portfolio, building new client relationships, etc., that contribute to achieving overall business objectives.

Let us now move on to learn why it is important for firms to measure project ROI.

Benefits of Calculating Project ROI

Calculating project ROI is beneficial for an organization for several reasons. It is not just a number but a reflection of a company’s strategic outcomes and overall performance. Some of the benefits of calculating ROI in project management are:

Enhances Project Prioritization

In several scenarios, an organization has multiple initiatives in the project pipeline. The expected ROI serves as a valuable decision-making tool in such cases as it provides clarity on which initiative is expected to deliver the highest returns. Based on this insight, organizations can easily prioritize projects that will bring the greatest financial or strategic benefit.

Read More: What is a Project Intake Process & How to Improve It?

Helps Assess Project Feasibility and Quantitative Value

In the absence of project ROI, firms can never know if their initiatives are delivering any tangible value. By estimating the ROI upfront, they get clarity on the project’s feasibility before committing resources and time. Moreover, it helps evaluate the value a project can deliver and prevent businesses from overcommitting to unviable ones, reducing the risk of loss from the beginning.

Drives Informed & Efficient Spending

By measuring ROI during the project initiation, execution, and delivery phases, businesses can make informed spending decisions. Firstly, it prevents overinvestment in initiatives that are expected to deliver low value. Secondly, when calculated during the execution phase, ROI helps optimize the use of available funds and prevent over expenditure. Lastly, when estimated after project delivery, it helps measure the financial success of the initiative.

Read More: 5 Project Selection Criteria to Structure the PMO

Promotes Financial Accountability

Using ROI as a performance metric promotes a culture of financial accountability across project teams. It allows managers to analyze the impact of their decisions on project finances. As a result, wasteful spending is reduced, and resources (especially financial ones) are utilized efficiently. Moreover, when a team’s performance is evaluated based on ROI, individuals are more invested in achieving optimal results.

Justifies Budget Allocation

In any organization, stakeholders want to know how much return they are getting for every dollar they invest. Calculating project ROI answers that question precisely. It provides managers with quantifiable data, which they can use to justify whether an investment is truly worthwhile. This financial transparency enhances trust and helps in getting faster project budget approvals for future initiatives.

Read More: Understanding Cost Baseline in Project Management: Components, Benefits & Steps

Accelerates Business Growth

A good project ROI history increases stakeholders’ trust and enhances the firm’s reputation in the market. This drives more business as clients will likely engage with them in the future or refer their services to others. Moreover, profitable projects generate excess capital, which can be utilized to acquire skilled individuals or implement advanced technologies. Over time, it enables organizations to scale operations and strengthen their competitive edge.

So far, we have explored ROI meaning, its types, and its benefits. Let us now learn how to calculate ROI for a project.

How to Calculate Project ROI?

Accurate Project ROI calculation depends on following a systematic approach that ensures all financial factors are taken into consideration. Here, we will understand ROI calculation through a step-by-step process:

Establish the Total Project Costs

The first step to accurately calculating ROI is summing up all the project costs. This includes labor, equipment, material, overheads, operational expenses, and indirect costs. Doing so gives managers full visibility of their estimated investment and ensures that they do not overlook any hidden costs that might have an impact on the ROI later.

Read More: Project Cost Management: Types, Importance, and Steps to Calculate It

Estimate the Net Profits

The next step is calculating the net profits expected to be generated from a project. These include direct revenue from product sales, cost savings from reduced resource consumption, efficiency gains that reduce time or effort, or any other additional quantifiable benefits. This step is crucial as it lays the groundwork for calculating ROI accurately.

Apply the ROI Formula

Once managers have calculated the total project costs and estimated net profits, they can apply the project ROI formula to arrive at final estimations. It provides a clear percentage that reflects how much financial return the project is expected to generate compared to its cost. Using this formula, managers can quantify a project’s financial performance into figures/percentages that are easy to understand and track.

Consider the Intangible Benefits

When estimating project ROI, it is also important to consider the non-financial benefits delivered by a project. These may include a better brand reputation, increased visibility in the market, enhanced customer satisfaction, improved workforce efficiency, etc. While these intangible benefits do not immediately reflect in financial outcomes, they are instrumental for long-term business growth.

Read More: Operational Efficiency: What is it, and How to Maximize & Boost ROI?

Compare with Expected ROI

The last step in calculating project ROI is comparing the actual with the expected ROI. Managers can use the same formula to calculate the final ROI, but this time, the actual investment cost and profits made are considered instead of estimations. This gives managers the final financial outcome of the project, which they can compare with the expected ROI to assess the performance.

Let us now explore an example to understand how these steps are applied in a real-world scenario for calculating ROI for a project.

Project ROI Example

To understand how to calculate ROI for a project, let us consider an example where a marketing agency has been hired by a brand to revamp its website and execute a digital launch campaign.

The brand’s approved budget for the project is $45,000. It is also the total revenue the agency expects to receive.

As part of the process, the agency incurs the following costs to deliver the project:

| Item | Cost ($) |

|---|---|

| Website design and development | $18,000 |

| Content creation | $3,000 |

| Ads spend | $10,000 |

| Overheads | $1,000 |

| Total | $32,000 |

After the project’s completion, the agency received $45,000 from the brand, while their costs were $32,000. Based on this, they calculate their net profit:

Net profit = Total revenue – Total expenses

= $45,000 – $32,000

= $13,000

Once the total costs and net profits of the project are recorded, the project ROI can be calculated as:

ROI (%) = (Net Profits / Total Cost of Investment) x 100

= ($13,000 / $35,000) x 100

= 37.14%

Beyond the financial gains, the agency also considers the intangible benefits. These include stronger customer retention, enhanced portfolio, potential future business opportunities, etc., which are not reflected in the 37.14% figure but contribute significantly to the agency’s brand value and growth.

Initially, the expected ROI was 30% based on the agency’s estimations, but the actual ROI of the project (37.14%) indicated that it outperformed expectations.

Having understood ROI calculation, let us now learn what some of the best practices are to improve project ROI.

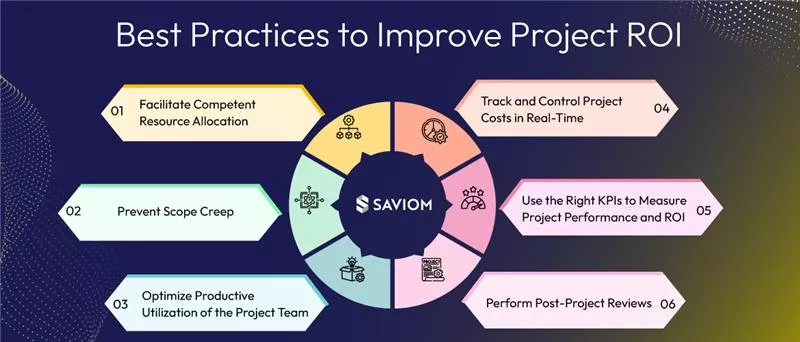

Best Practices to Improve Project ROI

If you often wonder what is a good ROI, the answer varies by industry. However, applying some of the best practices throughout the project lifecycle can help you improve outcomes. Here are some ways through which you can improve project ROI:

Facilitate Competent Resource Allocation

When the right resources are assigned to the right task and at the right cost, projects are completed with utmost efficiency. Moreover, by allocating resources based on skills and availability, managers can prevent underutilization (which leads to wasted potential) and overloading (which increases the risk of errors). As a result, productivity improves, project costs remain on track, and return on investment grows.

Prevent Scope Creep

Scope creep or uncontrolled changes in project scope can lead to schedule overruns and budget slippage, which result in a negative ROI. Therefore, to prevent this, firms must clearly define project scope at the outset and establish a formal change control process to evaluate the requested changes before accepting them. This, in turn, avoids unnecessary work that erodes profitability and ensures a high project ROI.

Read More: What is a Project Scope? Benefits, Best Practices, and Steps to Create an Effective One

Optimize Productive Utilization of the Project Team

The greater the time spent on billable or strategic tasks, the more the return. To optimize a team’s productivity, managers can leverage time-tracking tools. These tools help in monitoring billable vs. non-billable resource utilization. If the utilization level fails to meet the desired threshold, they can mobilize non-billable resources to high-value tasks. This way, they can enhance the top and bottom lines of the organization.

Use the Right KPIs to Measure Project Performance and ROI

Every project is unique, so the KPIs used to measure its performance must also be relevant to its specific goals and nature. Managers can use a mix of tangible KPIs like cost variance, schedule variance, etc., and intangible KPIs like customer satisfaction, stakeholder engagement, etc. By measuring quantitative and qualitative project metrics, managers can evaluate ROI as well as assess alignment with strategic goals.

Read More: Resource Management KPIs: 15 Metrics to Ensure Resource Efficiency and Project Success

Track and Control Project Costs in Real-Time

Managers must constantly track project costs by evaluating planned vs. actual expenses in real time. This enables project managers to detect potential cost overruns early and take timely corrective measures such as mobilizing resources from low-priority tasks to critical ones, renegotiating with vendors, etc. As a result, project financials remain aligned with the original budget, safeguarding project KPI.

Perform Post-Project Reviews

Conducting post-project reviews helps project managers analyze what worked well and what didn’t. This allows them to identify inefficiencies, missed opportunities, and areas for improvement. With the help of these insights, project teams can refine future strategies, which results in better resource planning, cost control, and overall efficiency. As a result, consistent post-project evaluations can significantly improve project ROI.

Let us now move on to understand how a modern project resource management tool can help businesses improve ROI.

How Can a Next-Gen Project Resource Management Tool Help Improve ROI?

Advanced resource management software can empower organizations with real-time data and insights that help control costs, minimize delays, and ensure successful delivery. The following are some of the features that contribute to improving project ROI:

1. The all-in-one resource planner of the tool offers enterprise-wide 360-degree visibility of all resources, which helps teams manage resource allocations seamlessly. It serves as a central hub for various other functionalities like:

- The multi-dimensional analysis helps slice-dice resource information based on different dimensions like costs, location, roles, etc., to find the best-fit personnel at the right cost, ensuring cost-effective resource allocation.

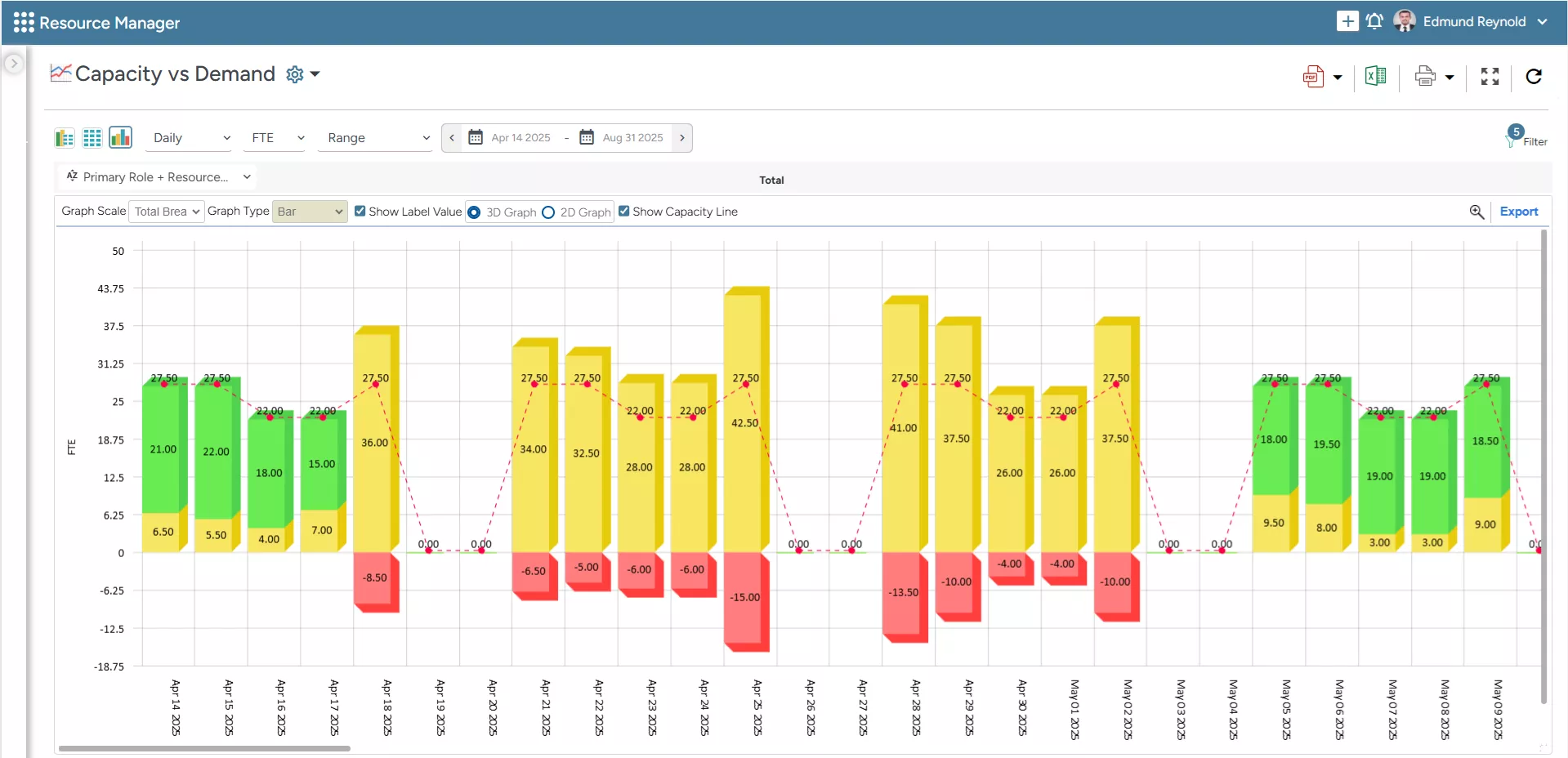

- The embedded capacity planner helps managers forecast upcoming project demands. Using this data, they can prevent resource shortages or excesses and avoid costly hiring at the last minute, which protects project ROI.

SAVIOM’s Capacity vs. Demand dashboard allows managers to forecast resource shortages/excesses and avoid last-minute costly hiring.

- The embedded heatmap allows managers to identify over/underutilized resources at a glance. This helps them mobilize under-utilized resources to productive and revenue-generating tasks, thereby improving ROI.

- The tool’s intelligent matchmaking feature ensures that the right talent is assigned to the right project, preventing chances of rework and cost escalations, which can negatively impact ROI.

- The KPI forecaster provides real-time insights into resource availability, utilization, capacity, etc., enabling managers to capitalize on excess capacity. This ensures that every resource contributes to the bottom line, thereby improving ROI.

2. The tool comes equipped with real-time BI capabilities, so managers get customized reports and dashboards that present resource data in an easy-to-understand format. For example, with forecast vs. actual cost reports, managers can track variances and take corrective actions to ensure profits are not hampered.

3. With the task/time management feature, managers can closely track employee timesheets and analyze if they spend more time on non-billable tasks. Based on this, they can optimize utilization and ensure people are mobilized toward high-priority, billable work.

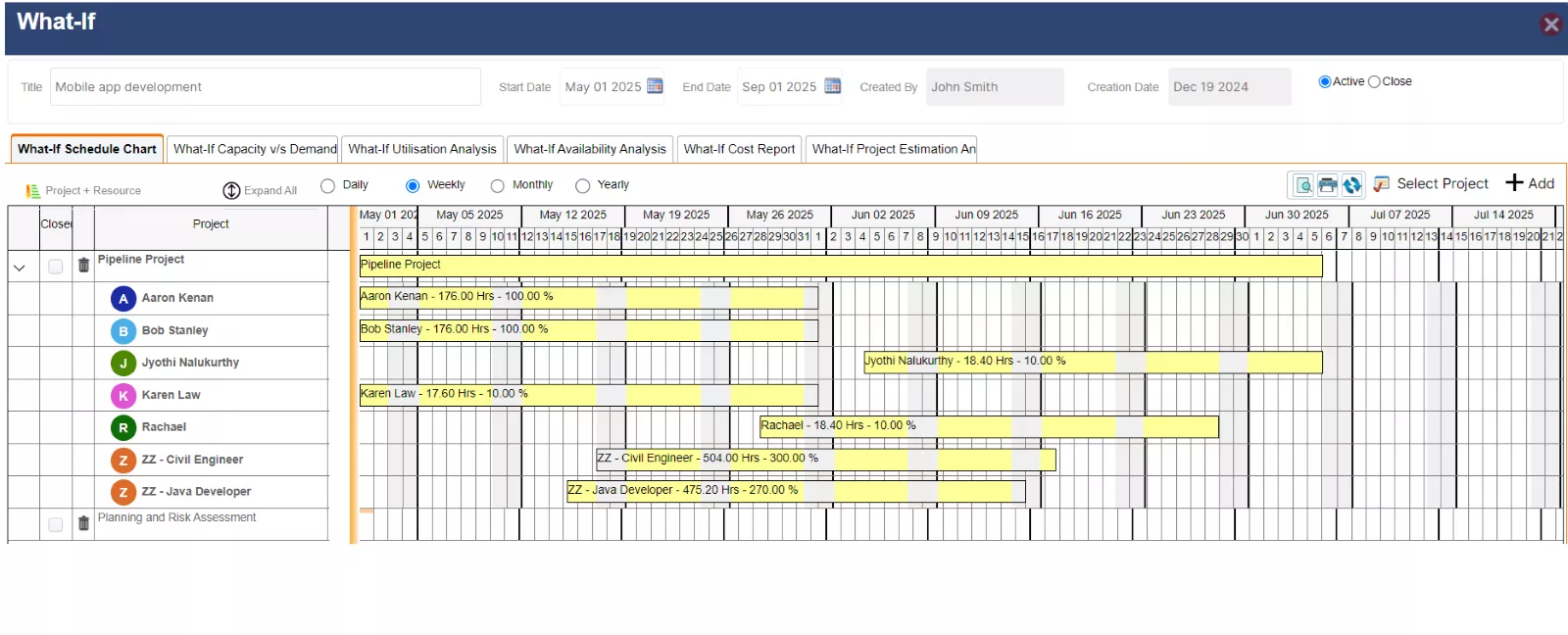

4. Lastly, the what-if analysis feature facilitates scenario-based resource optimization. With this, project managers can assess the impact of timelines, budgets, or resource utilization changes and arrive at the most profitable plan.

SAVIOM’s What-if Analysis feature allows managers to simulate different scenarios and help them make cost-effective decisions.

Conclusion

Measuring project ROI is an integral part of organizations as it provides a reality check on whether they are on track with their strategic and revenue goals. Beyond the numbers, it offers valuable insights into project performance, helping teams refine their future planning, budgeting, and execution strategies. It transforms ROI into a powerful tool for continuous improvement when done consistently.

So, how often do you review your project ROI to ensure you’re staying on track?

The Glossary

Read More: Glossary of Resource Workforce Planning, Scheduling and Management